While taxes may not be the most exciting part of running a yoga business, if you are familiar with how the system works and understand your requirements as a professional, you can gain confidence and avoid headaches during tax season.

Here are five tips to help you navigate the world of taxes.

- Keep accurate records

Keeping accurate records is essential to a smooth tax season. It is important to keep track of all your income and expenses throughout the year, including receipts for any yoga-related purchases, such as mats, props, and clothing. This will also help you understand what you can deduct or “write off” as a professional. Spreadsheets or accounting software are simple and helpful tools to track your money-in and money-out.

2. Understand your tax obligations

As a yoga teacher, you are considered self-employed, which means you are responsible for paying self-employment taxes. Self-employment taxes include both the employer and employee portions of Social Security and Medicare taxes. You will need to pay these taxes quarterly, using Form 1040-ES. In addition to self-employment taxes, you may also be required to pay state and local taxes, depending on where you live and work. Get ahead of the question marks and research your area’s tax laws to ensure you are meeting all your tax obligations.

3. Deduct eligible expenses

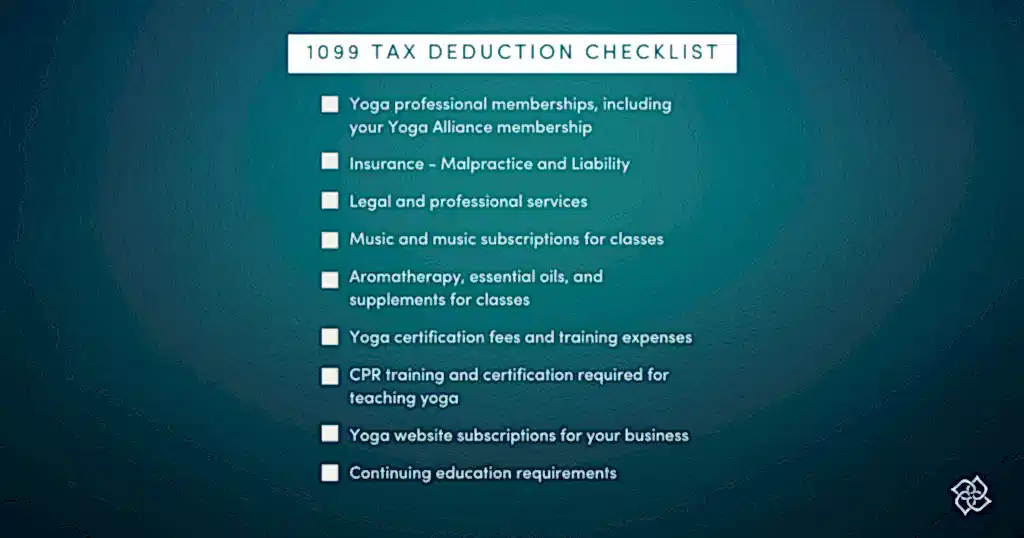

As a self-employed yoga teacher, you may be able to deduct certain expenses from your taxable income. Deductible expenses may include items such as yoga props, music, insurance, and travel expenses for attending workshops or training courses. Keep in mind that you can only deduct expenses that are related to your yoga business, so be sure to keep accurate records and receipts.

Sample deductibles:

4. Consider hiring a tax professional

There is no way to sugar coat it—taxes, red tape, and record-keeping can be confusing. If you are unsure about your tax obligations or have a complicated financial situation, it may be helpful to hire a tax professional. They can help you navigate your records and ensure you are meeting all tax obligations. They can also help you maximize your deductions and minimize your tax liability.

5. Plan for tax season (i.e., put money aside throughout the year!)

It is important to plan ahead so you have the money you need when tax season arrives. It is best practice to set aside a portion of your income for taxes each quarter, so it is there when you need it. By planning ahead, you will be better prepared to meet your tax obligations and avoid any penalties or interest charges.

Have questions or need help with your taxes? Learn more about available tax support for Yoga Alliance Members through the Member Assistance Program.